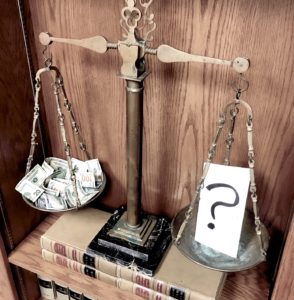

Crypto / Blockchain Businesses Surrender their Competitive Advantage with Weak Non-Compete Agreements

Non-Compete agreements have become commonplace within the Crypto Blockchain ecosystem. Most of these non-compete agreements are unenforceable. This is because the companies fail to draft a tailored non-compete agreement using a lawyer with specific expertise. This article explains what needs to occur.

Every Crypto / Blockchain business uses employees to leverage its competitive advantage over its competitors. Employees profit when they take that advantage, are hired by a competitor, or become a competitor themselves. Effective non-compete agreements protect against this risk. Basic, form non-compete agreements do not.

The cryptocurrency / blockchain field is expanding rapidly with many new businesses. Nearly all blockchain crypto businesses are small to medium size. New, small, and medium size companies usually cannot afford their own, high quality, experienced lawyer. Instead, legal issues are either ignored, or are delegated to an employee who “googles” for answers to legal questions.

Legal search engine answers are nearly always wrong. Analogies show how this is true. A crypto yield farmer would not “google” an answer for the “best liquidity mining strategy” and expect an accurate answer. A blockchain crypto software engineer would not “google” the “best way to scale a DeFi Ethereum-based application” and expect a meaningful answer. So, too, specialized legal experience is needed, but not obtained through non-specialist employees.

CRYPTO EMPLOYEES ARE LIKELY TO TAKE YOUR BUSINESS SECRETS WHEN THEY LEAVE

It is common for crypto / blockchain employees to start employment at one blockchain business, then later leave to work for themselves, or a competitor. Employment turnover exacerbates business secret risks for every crypto business’ confidential information.

It is common for crypto / blockchain employees to start employment at one blockchain business, then later leave to work for themselves, or a competitor. Employment turnover exacerbates business secret risks for every crypto business’ confidential information.

Two recent studies reveal the pervasiveness of this risk. The Verizon Data Breach Investigations Report analyzed 41,686 cyber security attacks. It included 2,013 data breaches from 73 data sources in 86 countries.

Outside cyber-attacks from crypto mining get much media attention. However, the Verizon study shows leaving employees are the real risk. External crypto attacks account for only 2% of business cyber-attacks. (Verizon study at page 3) Many breaches of confidential business information come from within. Specifically, the data show:

- 34% of information breaches are perpetrated by employee insiders.

- 2% involve partners, the executives and founders, themselves.

- 5% involve multiple employees colluding together.

- 43% of the victims are small businesses.

(Verizon study at page 3)

Stealing employees are not taking crypto confidential information for curiosity. Your stolen confidential information is being “sold” to your competitors as part of your former employee’s “employment package.”

Stealing employees are not taking crypto confidential information for curiosity. Your stolen confidential information is being “sold” to your competitors as part of your former employee’s “employment package.”

Indeed, a study reported by Information Security Magazine reveals the prevalence of employee theft:

- 72% of departing employees admit to taking company data.

- 70% of intellectual property theft occurs within the 90 days of the employee’s resignation announcement.

Your Employees are Taking Your Date, Richard Agnew, 10-10-2019, infosecurity-magazine.com

Are you a Founder or Executive? Watch Out!

Are you a Founder or Executive? Watch Out!

Founders, and business executives are at particular risk. In fact, C-suite level executives are 12 times more likely to be the target of an attack. (Verizon study at page 3)

Crypto and Blockchain businesses that store their secrets on the cloud must pay particular attention as the theft of confidential information stored on the cloud is rising rapidly.

NON-DISCLOSURE AGREEMENTS DO NOT PREVENT EMPLOYEE COMPETITON

Taking business secrets and confidential information is a breach of contract when the employee has signed an effective non-disclosure agreement. Taking confidential information is even a crime in some instances. However, non-disclosure agreements (NDAs) do not prevent an employee from taking the skills and residual knowledge you taught them, and becoming your competitor. Indeed, even in situations where an employee does take confidential business secrets, a poorly drafted NDA offers no protection.

Taking business secrets and confidential information is a breach of contract when the employee has signed an effective non-disclosure agreement. Taking confidential information is even a crime in some instances. However, non-disclosure agreements (NDAs) do not prevent an employee from taking the skills and residual knowledge you taught them, and becoming your competitor. Indeed, even in situations where an employee does take confidential business secrets, a poorly drafted NDA offers no protection.

WEAK NON-COMPETE AGREEMENTS OFFER PEACE OF MIND WITHOUT PROTECTION

Non-Compete agreements are common. In the United States, 18% of the entire workforce (30 million employees!) have signed a non-compete agreement. In fact, 40% of all workers will sign a non-compete agreement at some point in their career.

Non-compete agreements are common areas of top-down abuse. Only 10% of non-compete agreements undergo any employee negotiation. 40% sign the non-compete agreement after they are already employed. Id. Judges know this, and respond in favor of the employee who breaks his agreement, to the business’ detriment.

Non-compete agreements are common areas of top-down abuse. Only 10% of non-compete agreements undergo any employee negotiation. 40% sign the non-compete agreement after they are already employed. Id. Judges know this, and respond in favor of the employee who breaks his agreement, to the business’ detriment.

Many aspects of non-compete agreements defeat them, making the non-compete agreement unenforceable. These defects include:

- Failing to have “consideration” from the existing employee (like signing after he is already an employee)

- Being overly broad (the non-compete agreement tries to do too much, so the judge invalidates it entirely)

- Vague (If you can’t understand it; it is vague, and a judges may invalidate it)

- Does not comply with the laws of your jurisdiction (Form non-competes downloaded from the internet posted by businesses in other locations)

- Does not apply to the type of person using it (the non-compete is not tailored to your specific type of employee)

- Executives (C-suite officers will need special non-compete agreement drafting)

- Contractors (third party contractors require specialized non-compete language for the Non-Compete Agreement to be effective)

- Applies to the wrong type of conduct (different types of employees compete differently; enforceable non-compete agreements address these distinctions)

- Wrong Time Period (Most jurisdictions have specific rules for allowable time periods. Some businesses have different time period needs. Enforceable non-compete agreements need to be tailored for the “time” issue)

- No Legitimate Company interest (This is an element for a non-compete agreement in many places; what a “legitimate interest” is differs from place to place)

- Employee does not have the “unique” or extraordinary skills” required for the agreement to be enforceable (Your subway sandwich maker is not subject to an enforceable non-compete agreement. A crypto yield farming analyst is. A blockchain programmer will qualify for an enforceable non-compete agreement)

- Employee was not fired for cause (Some judges require the employee to be fired for good reason before the non-compete agreement is enforced. You fire an employee for no good reason, which may be your right, you risk creating a competitor)

- You Waived any restrictions (Some judges will look to the actions and statements of the employer and declare a non-compete agreement invalid, if those actions do not meet the judge’s approval)

- You have no remedy (You may have a valid, enforceable, non-compete agreement, but cannot cure the problem, like with a foreign company in an uncooperative jurisdiction. You cannot collect against a party with no traceable money)

- You Cannot Enforce against this party (collection, venue)

Competition between businesses in the crypto blockchain ecosystem is fierce. Your competitive advantage may be only slight compared to other crypto businesses.

Competition between businesses in the crypto blockchain ecosystem is fierce. Your competitive advantage may be only slight compared to other crypto businesses.

One can conquer the world with only a slight advantage; it is true. Compare with an analogy to sports. The sports team who scores only once more than its competitor, wins every game! So, too, a blockchain crypto company that barely but consistently wins over each customer, gets all the profit.

Companies act through their employees. It is these employees who bring reality to the vision of their founders and executives. Your competitive advantage is lost when your employees take your advantage to your competitor.

Large, wealthy corporations with large legal departments know this. They draft specifically tailored non-compete agreements with care. Large company non-compete agreement lawyers adapt these restrictive covenants so they are enforceable.

New, small crypto businesses often overlook this detail, and pay the price when they powerlessly watch their former employee turn into their competitor.

New, small crypto businesses often overlook this detail, and pay the price when they powerlessly watch their former employee turn into their competitor.

Author:

Matt Hamilton, Juris Doctor

Matt Hamilton, Juris Doctor

Sometimes you do not have to directly pay the lawyer at all. Certain types of cases (like vexatious refusal to pay by insurance) carry with them awards of attorney fees. This means at the end of the case, if you win, the other side pays for your attorney’s fees.

Sometimes you do not have to directly pay the lawyer at all. Certain types of cases (like vexatious refusal to pay by insurance) carry with them awards of attorney fees. This means at the end of the case, if you win, the other side pays for your attorney’s fees. Like stairs, contingency fee amounts typically go up in steps.

Like stairs, contingency fee amounts typically go up in steps.