Why it Matters

Whether Your Crypto Token is a Security

Why is there this big stink among Web3 crypto companies registering their crypto tokens with the SEC?

Why is there this big stink among Web3 crypto companies registering their crypto tokens with the SEC?- Why does the SEC spend so much time oppressing crypto?

- Isn’t there a solution to all this SEC Crypto fighting?

- What is a Web3 company to do?

This article discusses the reasons and available solutions. Let’s begin!

THE GIST!

- Many Crypto Blockchain Token releases are in criminal violation of U.S. Securities Laws

- The Securities Exchange Commission is trying to protect the public from ignorance, insider market manipulation, and fraud.

- SEC requirements oppress Crypto/Web3 businesses with economically insurmountable registration requirements; implementation of its public safety goal stifles market development, and cedes U.S. dominance

- There is a legal way to register a security

WHAT IS A “SECURITY” SPECIFICALLY?

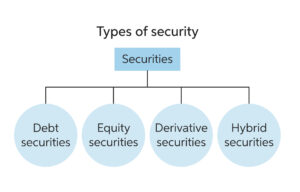

A security is a financial instrument a business uses to raise money.

There are four main security types of securities:

There are four main security types of securities:

- Equity (an ownership stake in the company)

- Debt (a loan that must be repaid)

- Derivatives (value of one thing linked to the value of another)

- Hybrids (combinations of ownership and debt)

The test of whether a token is a security is complex. The test surrounds four elements:

The test of whether a token is a security is complex. The test surrounds four elements:

- An investment of money

- A common enterprise

- An expectation of profits

- Value coming from the actions of a third party (not from the investor)

Token Letters: Web3 securities lawyers issue opinion letters breaking down whether a given crypto project is or is not a security. These analysis letters help ERC-20 tokens and the like get listed on exchanges. They also provide a guide for the Web3 business to avoid legal problems. Token letters even help blockchain businesses avoid SEC lawsuits by making the case of why the crypto is not a security. Token letters are usually more than twenty-five pages long. Complexity surrounds the issue of whether a given crypto is a “security.”

WHO DECIDES WHETHER A CRYPTO TOKEN IS A SECURITY?

The Securities and Exchange Commission does not decide whether a crypto token is a “security.” A United States District Court federal judge decides. The SEC must sue the business that controls the crypto token/digital asset/”security.” Then, the federal judge decides whether United States law does or does not mandate registration as a security.

The Securities and Exchange Commission does not decide whether a crypto token is a “security.” A United States District Court federal judge decides. The SEC must sue the business that controls the crypto token/digital asset/”security.” Then, the federal judge decides whether United States law does or does not mandate registration as a security.

For example, the SEC sued LBRY Credit in 2021 over its LBC coins. The SEC brought its action before Judge Barbadoro in the United States District Court for the District of New Hampshire. The SEC alleged LBC crypto tokens were an unregistered security. The SEC alleged that LBRY Credit sold 600 million LBC since 2016 in violation of the Securities Act of 1933. It was the federal district court that decided LBC was a security.

Another example, the SEC is currently suing Ripple Labs over selling 14.6 billion XRP, bringing in $1,380,000.00 ($1.38B USD) in revenue. There was no SEC registration. No exemption from SEC registration was filed. The SEC brought its action in the United States District Court of Southern New York. The SEC complains that Ripple never provided investors with material information when soliciting money for them to buy XRP. The SEC alleges Ripple insiders created an “information vacuum” they alone controlled. The case remains pending.

WHY DOES THE S.E.C. CARE WHETHER A CRYPTO TOKEN IS A SECURITY?

Coinbase worries about the SEC. Kim Kardashian had to pay $1,260,000.00 in SEC penalties over crypto. FTX, EMAX, Kraken, even Do Kwon is having SEC crypto issues. So, why does the SEC care?!

worries about the SEC. Kim Kardashian had to pay $1,260,000.00 in SEC penalties over crypto. FTX, EMAX, Kraken, even Do Kwon is having SEC crypto issues. So, why does the SEC care?!

The Securities and Exchange Commission is trying to protect the public … ordinary investors. The SEC’s intent is to protect individual investors (the public) from losing money because they have not been given enough information to evaluate the investment risk. The SEC tries to accomplish public protection with four missions:

- Preventing market manipulation,

- Forcing the disclosure of critical information to buyers and other involved persons,

- Stopping fraud, and

- Leveling the playing field between wealthy, powerful insiders and regular people who want to invest.

The SEC strives to make U.S. securities markets honest, and fair.

So… why is there a problem, given such noble aims?

Why do so many in crypto resent and resist the SEC and other regulatory agencies for achieving their noble goals? The reason is implementation.

The cost and trouble of satisfying SEC requirements exceeds the man-power time, and money available to virtually all small businesses.

The cost and trouble of satisfying SEC requirements exceeds the man-power time, and money available to virtually all small businesses.

Nearly all crypto/blockchain businesses are small. Crypto business are undercapitalized at this phase of the industry’s development. Thus, most everyone agrees with the purposes and goals of government security agencies. However, most disagree with the stifling effect of government security agency implementation.

WHY DOESN’T THE PRESIDENT JUST TELL THE SEC TO “BACK OFF CRYPTO!?”

The President of the United States can influence the administrative agencies of government. However, the President does not directly control SEC activities.

The President of the United States can influence the administrative agencies of government. However, the President does not directly control SEC activities.

The Securities and Exchange Commission is semi-independent. The U.S. President appoints the Commissioner of the SEC. Congress then approves or rejects the President’s appointment. It is then up to the SEC Commissioner to implement his or her vision of how the agency operates.

The SEC has independent powers to:

- Issue Cease and Desist Orders

- Fine

- Sue for money

- Prosecute for jail time, partnering with U.S. District Attorneys

The Securities and Exchange Commission is not even purely executive. The SEC has both quasi legislative and quasi executive powers. It creates and implements its own regulations to carry out laws passed by Congress (as long ago as 1933).

WHY DON’T CRYPTO COMPANIES JUST REGISTER WITH THE SEC AND STOP COMPLAINING?

The SEC and its ilk offer the crypto/blockchain industry a Hobson’s choice. Go bankrupt attempting to comply with U.S. Securities laws, or operate illegally, and hope to get away with the crime until the business is successful enough to operate legally.

The SEC and its ilk offer the crypto/blockchain industry a Hobson’s choice. Go bankrupt attempting to comply with U.S. Securities laws, or operate illegally, and hope to get away with the crime until the business is successful enough to operate legally.

Resistance to the SEC also stems from the fraudulent nature of so many crypto projects. It is widely believed that more than seventy percent of crypto projects are baseless, or outright frauds. Blockchain businesses with sound foundations and good intentions rightly feel unfairly grouped with the fraudsters.

Instead, “good” crypto projects find solace in the belief that government regulatory and enforcement agencies will go after the worst-first. Thus, competent, well-intentioned businesses have time to mature before being targeted. Their argument favoring not complying with the law thus goes:

Instead, “good” crypto projects find solace in the belief that government regulatory and enforcement agencies will go after the worst-first. Thus, competent, well-intentioned businesses have time to mature before being targeted. Their argument favoring not complying with the law thus goes:

- Time is on your side.

- Compliance is impractical.

So,

- Don’t outright cheat people.

- Work hard.

- Succeed first.

- Comply later.

WHAT MUST A CRYPTO COMPANY DO IF ITS TOKEN IS A SECURITY?

A Crypto / Blockchain company must register with the Securities and Exchange Commission prior to offering a security for sale to the public. Detailed information must be provided in the SEC filing.

A crypto business must be mindful. To whom is the security being sold? Securities laws divide buyers between “accredited” investors, and the public at large. Different disclosures at wildly differing costs are required if buyers are “accredited” versus unaccredited.

A crypto business must be mindful. To whom is the security being sold? Securities laws divide buyers between “accredited” investors, and the public at large. Different disclosures at wildly differing costs are required if buyers are “accredited” versus unaccredited.

A crypto business must be mindful. How much money does it intend to raise with the offering? Selling to investors is tiered depending upon how much money might be made. Sales of less than one million dollars in any twelve-month period have different requirements than open sales.

What is the problem with most crypto token sales? The problem is most crypto offerings are direct to the public, with little information on who is buying, and no upper limit on profits. Spiderman’s Uncle Ben said to Peter Parker, “with great power comes great responsibility.” Ivy league intellectuals might call this the medieval principal of noblesse oblige. Profits cannot be enjoyed for their privileges alone. Profits come at the price of moral responsibility. The United States Securities Exchange Commission calls retail token sales (IPO, IEO, etc.) a “direct public offering.”

What is the problem with most crypto token sales? The problem is most crypto offerings are direct to the public, with little information on who is buying, and no upper limit on profits. Spiderman’s Uncle Ben said to Peter Parker, “with great power comes great responsibility.” Ivy league intellectuals might call this the medieval principal of noblesse oblige. Profits cannot be enjoyed for their privileges alone. Profits come at the price of moral responsibility. The United States Securities Exchange Commission calls retail token sales (IPO, IEO, etc.) a “direct public offering.”

A direct public offering is when a business sells direct to the public without an underwriter. A direct public offering is the most expensive, time intensive, easiest way to get sued, and criminally fraught method to sell crypto.

WHAT INFORMATION DOES A CRYPTO SECURITY HAVE TO DISCLOSE?

1. The crypto business discloses to the government.

2. The government discloses to the public.

= That is the process.

The SEC Requires the disclosure of the following categories of information in SEC filings, which must also be made available to potential security buyers. The information includes:

The SEC Requires the disclosure of the following categories of information in SEC filings, which must also be made available to potential security buyers. The information includes:

- Business management

- Business assets

- Business financial statements

The disclosure document the crypto company must disclose is called a “prospectus.” Think of a summary form, revealing the most summary information:

- The issuer

- The security

- The terms

- Basic financial information

- Balance sheets

Any prospectus needs detail. Accuracy requirements for any prospectus govern. An entire industry of lawyers make their money suing companies who make prospectus errors/omissions. A prospectus is thus a legal requirement and an invitation to be sued.

The registration “prospectus” is different than a statement S-1. Think of the prospectus as being for the public at large (that being a very well informed, sophisticated public). The statement S-1 is the full disclosure for investment professionals, hedge funds, academics, the most sophisticated of researchers.

S-1s are usually created by larger corporate entities offering securities to the public at-large. The S-1 employs hundreds of regulations. One could fill a library detailing what S-1 statements cover.

There are also ongoing disclosure requirements for crypto companies who issue securities. Ongoing disclosures include:

- Initial disclosure of information (operations, equity structure, and basics of each security)

- Annual reporting (Form 10-K with operational data, company performance, audited financial statement, and officer/executive information)

- Quarterly reports (Form 8-K, operational, structural, financial, security issuances, mergers, acquisitions, auditor changes, and ownership changes)

- Special reports (Form 8-K with major changes in operations, structure, stock issues, mergers, acquisitions, or changes in auditing)

Is an accounting audit needed for a crypto security to register with the SEC as a security? Yes.

Does a crypto security need to register with a State if it is registered with the SEC? Yes.

DO THE PERSONS INVOLVED IN THE SALE OF A CRYTO SECURITY NEED TO REGISTER?

Yes. There are federal registration requirements for any broker or dealer in crypto securities. For example, brokers must file Form BD to legally be involved in the sale of a crypto that is a security. (Section 15 Securities Act of 1934)

Disclosed information will include:

Disclosed information will include:

- Their background

- Management policies

- Personnel

- Business successors

- Pending litigation

- Past securities law violations

- Membership in the National Association of Securities Dealers

- Membership in the Security Investor Protection Corporation

- State-level registrations wherever the security is intended to be sold

IS A LICENSE NECESSARY FOR A PERSON INVOLVED IN THE SALE OF A CRYTO SECURITY?

Yes. A license is necessary both at the state and the federal level. Please see this page for detailed information on licensing for crypto /Web3 professionals who wish to be licensed for securities or commodities.

WHAT CAN A CRYPTO COMPANY DO IF ITS TOKEN IS LABELED A “SECURITY?”

There are legal options available to small crypto companies with limited funds. A competent securities lawyer can structure a crypto release that complies with U.S. law, even when the crypto will be a security.

REGULATION D IS AN OPTION FOR CRYPTO SECURITIES

For example, the token can be released to select investors, accredited in advance. See our details on the Regulation D Crypto Exemption here.

CRYPTO COMPANIES MAY QUALIFY AS AN EMERGING GROWTH COMPANY FOR A SECURITIES RELEASE

Web3 businesses benefit from qualifying as an “emerging growth company” (EGC) with the Securities Exchange Commission. There are many benefits from being an EGC:

Web3 businesses benefit from qualifying as an “emerging growth company” (EGC) with the Securities Exchange Commission. There are many benefits from being an EGC:

- EGCs get to file a preliminary prospectus before a public filing.

- The preliminary prospectus is confidential with the SEC

- The preliminary prospectus allows the EGC to get insights, to amend, and edit.

- EGCs experience less expensive accounting costs as they do not have to employ certain accounting standards

- ECGs have relaxed updating standards for their financial statements.

- Emerging Growth Companies have lower audit costs. This is because they do not have to comply with PCAOB rules (rotating audit firms).

- Auditor attestations of internal controls are not required, which saves money (SOX §404(b) 2002).

- EGCs do not have to disclose most executive compensation information.

- There are not “say-on-pay voting requirements (shareholders approving executive pay).

To qualify as an Emerging Growth Company, a business must do the following:

- Hire an independent auditor for its financial statements

- Provide two years of financial statements to the SEC (as opposed to three for other businesses)

- Make less than one billion dollars in total gross revenue within the last twelve months

- Company ownership stock shares must have been issued within the last five years

- Company must not have offered more than one billion dollars in bonds in the last three years

- Company must not have a “public float” of more than $700,000.00 (large accelerated filer)

CROWDFUNDING IS AN OPTION FOR CRYPTO SECURITIES

Want to sell to the public at large? That can be done too! Let us face it. Do you really expect to profit more than one million dollars from your crypto offering in the next twelve months? Maybe… Maybe… That bridge should be crossed when you arrive. Until that day, the crowdfunding exception to a direct public offering is a good option for cypto startups.

Want to sell to the public at large? That can be done too! Let us face it. Do you really expect to profit more than one million dollars from your crypto offering in the next twelve months? Maybe… Maybe… That bridge should be crossed when you arrive. Until that day, the crowdfunding exception to a direct public offering is a good option for cypto startups.

Crowdfunding is a legal option. Are there limitations? Yes. Crowdfunding limitations for Web3 companies include:

- Money raised must be less than one million US dollars in any twelve month period.

- Individual buyers must spend less than two thousand dollars or five percent of their income if they earn less than one hundred to thousand dollars per year. (use forms)

- Individual buyers must spend less than ten percent of their annual income (or net worth, <$100K) if they’re worth more than one hundred thousand dollars

- Sell using a broker or “fundraising portal.”

WHAT CAN HAPPEN TO A CRYPTO COMPANY THAT FAILS TO REGISTER ITS SECURITIES WITH THE SEC?

WHAT CAN HAPPEN TO A CRYPTO COMPANY THAT FAILS TO REGISTER ITS SECURITIES WITH THE SEC?

A Web3 business that issues crypto or other instrument is deemed a security faces three risks. First, the company and its executives can be sued by the purchasers (Rule 10(b)(5)). Any purchaser can sue the Web3 business to rescind the purchase, plus interest. A purchaser can also sue for damages from their security purchase (the purchase price). A purchaser can also sue the Web3 business for the damages they allege, plus lost dividends, plus fees paid, taxes paid, interest, and consequential damages. If money is not enough, a purchaser can sue to rescind the security purchase (receive a put).

Second, the company and its executives can be sued by the SEC. The SEC will sue to fine the Web3 business (get its money). Fines for securities violations can be as high as twenty-five million dollars.

Third, the company and its executives can be criminally prosecuted. Willful action is a requirement. Prosecutions for securities violations typically revolve around fraud or deceit. Specific attention is paid to applications, reports, and registrations for their accuracy. Web3 business owners and employees can be imprisoned for up to twenty years. Three years of supervised release is an option.

WHAT IS A WEB3 BUSINESS TO DO AGAINST SUCH SEC THREATS?

WHAT IS A WEB3 BUSINESS TO DO AGAINST SUCH SEC THREATS?

Each Web3/Crypto business must employee an attorney (or group of attorneys) to guide the process. SEC issues/problems are serious. The problems can bankrupt the business and land people in prison.

Surpassing the “security” SEC issue opens a Web3/Crypto business to thrive as competitors are eliminated. It will be the Survivors who become Unicorns.

My advice is to begin with the end in mind, thoughtfully plan and implement through this legal process. Success will be there for those who reach it.

- Juris Doctor

- Trial Attorney

14 DAO Issues You Must Consider Before Incorporating

14 DAO Issues You Must Consider Before Incorporating A “legal wrapper” for a

A “legal wrapper” for a  What are the Benefits of a DAO Legal Wrapper?

What are the Benefits of a DAO Legal Wrapper? DAO members often fail to realize the risks they take when the DAO is unincorporated. These risks include:

DAO members often fail to realize the risks they take when the DAO is unincorporated. These risks include: People love making labels. Sometimes the person making the new label seeks to make a better label. Other times, the person making the new label seeks to avoid a problem with the original label. Let’s face it; many people love renaming just so they can say “I invented the ________!” And … who loves unearned credit more than a politician? So, the list of DAO names now includes:

People love making labels. Sometimes the person making the new label seeks to make a better label. Other times, the person making the new label seeks to avoid a problem with the original label. Let’s face it; many people love renaming just so they can say “I invented the ________!” And … who loves unearned credit more than a politician? So, the list of DAO names now includes: The States have begun to enact DAO specific laws to recognize them as entities, and provide a framework for DAO operations. Each embodies a State intent to promote DAO and Web3 business within its borders. The laws are presently coded as:

The States have begun to enact DAO specific laws to recognize them as entities, and provide a framework for DAO operations. Each embodies a State intent to promote DAO and Web3 business within its borders. The laws are presently coded as: Certain types of businesses require a

Certain types of businesses require a  The location in which a DAO is legally formed created the legal framework for the entire DAO. This makes DAO location choice a critical decision. The DAO becomes a legal, separate entity according to that jurisdiction’s laws irrespective of what its smart contract, operating agreement, or protocols may mandate.

The location in which a DAO is legally formed created the legal framework for the entire DAO. This makes DAO location choice a critical decision. The DAO becomes a legal, separate entity according to that jurisdiction’s laws irrespective of what its smart contract, operating agreement, or protocols may mandate. There are a number of options for an individual to become a contributing DAO “member.” Member options can be:

There are a number of options for an individual to become a contributing DAO “member.” Member options can be: DAOs Limited by Time or an Event:

DAOs Limited by Time or an Event: Immortal DAOs:

Immortal DAOs: Most organizations, when formed, intend to start operating immediately. However, a DAO may have good reasons to file its necessary paperwork, but still delay its official formation. For example:

Most organizations, when formed, intend to start operating immediately. However, a DAO may have good reasons to file its necessary paperwork, but still delay its official formation. For example: The DAO must decide whether voting members or any employees will be fiduciaries. A

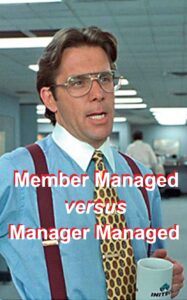

The DAO must decide whether voting members or any employees will be fiduciaries. A  The U.S. State law presumption is that a DAO is Member Managed, if not otherwise stated. This State law requirement is a bit of a false distinction. Namely, whether the DAO is member-managed or algorithm managed (Tennessee). The truth is: every DAOs is an interplay and mix of member and algorithm management.

The U.S. State law presumption is that a DAO is Member Managed, if not otherwise stated. This State law requirement is a bit of a false distinction. Namely, whether the DAO is member-managed or algorithm managed (Tennessee). The truth is: every DAOs is an interplay and mix of member and algorithm management. Manager Management: DAO Blasphemy … But An Option

Manager Management: DAO Blasphemy … But An Option Member participation and voting often has a low rate for DAOs, especially for mundane tasks. This can be a real problem if the DAO is incorporated in a State that mandates a majority quorum. Some states require a majority quorum for a valid DAO vote (Tennessee). Other jurisdictions allow quorum voting requirements to be defined in the DAO Operating Agreement.

Member participation and voting often has a low rate for DAOs, especially for mundane tasks. This can be a real problem if the DAO is incorporated in a State that mandates a majority quorum. Some states require a majority quorum for a valid DAO vote (Tennessee). Other jurisdictions allow quorum voting requirements to be defined in the DAO Operating Agreement. A State-recognized decentralized autonomous organization will have added burdens not imposed upon other LLCs, Trusts, and Corporations. For example:

A State-recognized decentralized autonomous organization will have added burdens not imposed upon other LLCs, Trusts, and Corporations. For example: A tiered, specialized legal structure is likely needed for any DAO that issues a crypto token. This is needed to comply with legal-regulatory mandates. This is needed to protect the DAO and its members from legal liability. This is needed to protect investors. There are tax issues that increase the need. Paying employees can be an issue. Banking may be an issue.

A tiered, specialized legal structure is likely needed for any DAO that issues a crypto token. This is needed to comply with legal-regulatory mandates. This is needed to protect the DAO and its members from legal liability. This is needed to protect investors. There are tax issues that increase the need. Paying employees can be an issue. Banking may be an issue.

It is great that your nephew, or spouse’s sibling needs a job. However, the Registered Agent of your business is the wrong opportunity to offer. The job of the registered agent is to receive filings, tax notices, court notices, official documents. Choosing the wrong person may lead to problems, like:

It is great that your nephew, or spouse’s sibling needs a job. However, the Registered Agent of your business is the wrong opportunity to offer. The job of the registered agent is to receive filings, tax notices, court notices, official documents. Choosing the wrong person may lead to problems, like: The registered agent is the public face of the business. The agent is occasionally the only actual person identified in the Articles of Incorporation. You should expect your business to be investigated at some point. This investigation may be for a potential sale, merger, or acquisition. This investigation may be an important customer evaluating your business for a great opportunity. This investigation may be a government employee considering business culpability. What will an investigation into your registered agent find? You want a look into your registered agent to improve, not detract from your reputation.

The registered agent is the public face of the business. The agent is occasionally the only actual person identified in the Articles of Incorporation. You should expect your business to be investigated at some point. This investigation may be for a potential sale, merger, or acquisition. This investigation may be an important customer evaluating your business for a great opportunity. This investigation may be a government employee considering business culpability. What will an investigation into your registered agent find? You want a look into your registered agent to improve, not detract from your reputation. Some jurisdictions require businesses to disclose the type of owner decision-making control the entity will use. These Certificate of Formation disclosure broadly break down the options between:

Some jurisdictions require businesses to disclose the type of owner decision-making control the entity will use. These Certificate of Formation disclosure broadly break down the options between: The largest advantage of any business has been specialization of skills, and coordination of activities. Company’s crave clarity. The best most efficient businesses match up people’s talents and experience with their best role in the organization. What goes for employees should also go with management. Executive decisions should be made by the person with the best qualities to make those decisions. However, in a Member Managed corporation, any owner of equity in the company can make decisions, regardless of whether there is a fit between the decision and their experience.

The largest advantage of any business has been specialization of skills, and coordination of activities. Company’s crave clarity. The best most efficient businesses match up people’s talents and experience with their best role in the organization. What goes for employees should also go with management. Executive decisions should be made by the person with the best qualities to make those decisions. However, in a Member Managed corporation, any owner of equity in the company can make decisions, regardless of whether there is a fit between the decision and their experience. Decision making authority is also not divided in member managed companies. This means that any member can make business decisions. This can cause several problems. First, employees will quickly learn who is likely to decide in a particular way given the circumstances. Employees will be able to direct questions and decisions to the owner (member) they expect is most likely to agree with them.

Decision making authority is also not divided in member managed companies. This means that any member can make business decisions. This can cause several problems. First, employees will quickly learn who is likely to decide in a particular way given the circumstances. Employees will be able to direct questions and decisions to the owner (member) they expect is most likely to agree with them. Second, one member (owner) may not agree with the decision of another member (owner). With all members having authority to decide, conflicts are more likely to arise with the overlapping authority granted by member managed organizations.

Second, one member (owner) may not agree with the decision of another member (owner). With all members having authority to decide, conflicts are more likely to arise with the overlapping authority granted by member managed organizations. Third, some decisions may be put off, or not made, at all in member managed entities. We all have experienced problems with which we just did not want to deal. In a member managed organization, since it is every member’s responsibility, it is also no member’s responsibility (in particular). This means someone can always state (I thought that other person was going to deal with it). Worse, some members (owners) may always delegate unpopular decisions to a particular member, making them the company “Storm Crow.” This will lead to resentment, at best.

Third, some decisions may be put off, or not made, at all in member managed entities. We all have experienced problems with which we just did not want to deal. In a member managed organization, since it is every member’s responsibility, it is also no member’s responsibility (in particular). This means someone can always state (I thought that other person was going to deal with it). Worse, some members (owners) may always delegate unpopular decisions to a particular member, making them the company “Storm Crow.” This will lead to resentment, at best. An owner may die. That owner’s heirs may inherit the owner’s business equity interest. Those heirs, whom you may not know, and who may know nothing about the business, suddenly are managers with authority.

An owner may die. That owner’s heirs may inherit the owner’s business equity interest. Those heirs, whom you may not know, and who may know nothing about the business, suddenly are managers with authority. There are other Mistakes with Articles of Incorporation. They are not “fleshed out” in this article as the Top 6, because of their limited application (only problems for some types of businesses. Other errors may be less frequent. They may be correctable. Other errors include:

There are other Mistakes with Articles of Incorporation. They are not “fleshed out” in this article as the Top 6, because of their limited application (only problems for some types of businesses. Other errors may be less frequent. They may be correctable. Other errors include:

5 Operating Agreement Mistakes that Will Ruin Your Business

5 Operating Agreement Mistakes that Will Ruin Your Business One problem is the business managers do not know what is in the operating agreement; or worse, they do not know what the operating agreement is missing. It is common for businesses to get their operating agreement in three ways:

One problem is the business managers do not know what is in the operating agreement; or worse, they do not know what the operating agreement is missing. It is common for businesses to get their operating agreement in three ways: Imagine a small but growing crypto startup wants to create blockchain infrastructure bridges so that one crypto blockchain can efficiently transfer tokens to other crypto blockchains. In crypto businesses, there are many specialized experts. There are people skilled in one field, and not as skilled in other fields. Business progress is uneven. Business challenges can be overcome quickly, or get bogged down for months costing millions.

Imagine a small but growing crypto startup wants to create blockchain infrastructure bridges so that one crypto blockchain can efficiently transfer tokens to other crypto blockchains. In crypto businesses, there are many specialized experts. There are people skilled in one field, and not as skilled in other fields. Business progress is uneven. Business challenges can be overcome quickly, or get bogged down for months costing millions. A blockchain legal consultant may have a great grasp of international law, SEC registration, and contracts to secret confidential information. It would be a mistake for a blockchain lawyer to have responsibilities and authority to manage the programming of C++, Python, and JavaScript, even if the blockchain lawyer is an owner.

A blockchain legal consultant may have a great grasp of international law, SEC registration, and contracts to secret confidential information. It would be a mistake for a blockchain lawyer to have responsibilities and authority to manage the programming of C++, Python, and JavaScript, even if the blockchain lawyer is an owner. An operating agreement that mandates Manager managed operations allows skills, experience, and passion to be paired with the best position within the business. It avoids the two problems of:

An operating agreement that mandates Manager managed operations allows skills, experience, and passion to be paired with the best position within the business. It avoids the two problems of: These events can cause owners to be forced to be business partners with persons they do not know, or do not like.

These events can cause owners to be forced to be business partners with persons they do not know, or do not like. Author:

Author:

It is common for crypto / blockchain employees to start employment at one blockchain business, then later leave to work for themselves, or a competitor. Employment turnover exacerbates business secret risks for every crypto business’ confidential information.

It is common for crypto / blockchain employees to start employment at one blockchain business, then later leave to work for themselves, or a competitor. Employment turnover exacerbates business secret risks for every crypto business’ confidential information. Stealing employees are not taking crypto confidential information for curiosity. Your stolen confidential information is being “sold” to your competitors as part of your former employee’s “employment package.”

Stealing employees are not taking crypto confidential information for curiosity. Your stolen confidential information is being “sold” to your competitors as part of your former employee’s “employment package.” Are you a Founder or Executive? Watch Out!

Are you a Founder or Executive? Watch Out! Taking business secrets and confidential information is a breach of contract when the employee has signed an effective

Taking business secrets and confidential information is a breach of contract when the employee has signed an effective

Non-compete agreements are common areas of top-down abuse.

Non-compete agreements are common areas of top-down abuse.  Competition between businesses in the crypto blockchain ecosystem is fierce. Your competitive advantage may be only slight compared to other crypto businesses.

Competition between businesses in the crypto blockchain ecosystem is fierce. Your competitive advantage may be only slight compared to other crypto businesses.

Bad News: It may be that you should not want to disclose your confidential business information to this other party; whatsoever, irrespective of how enticing the prospects. The sooner you come to this realization, the better.

Bad News: It may be that you should not want to disclose your confidential business information to this other party; whatsoever, irrespective of how enticing the prospects. The sooner you come to this realization, the better. A pre NDA investigation is how this information is discovered so that it may be put to use.

A pre NDA investigation is how this information is discovered so that it may be put to use. The point of having a non-disclosure agreement is for it to actually protect your business secrets.

The point of having a non-disclosure agreement is for it to actually protect your business secrets. David vs. Goliath – Large organizations tend to disregard small businesses. This may result from the diffusion of responsibility within the larger business. This may result from a large entity “profit at all costs” culture. Whatever the root cause, there has always been a tradition of larger, more powerful parties profiting at the expense of the smaller party. This tradition persists to this day.

David vs. Goliath – Large organizations tend to disregard small businesses. This may result from the diffusion of responsibility within the larger business. This may result from a large entity “profit at all costs” culture. Whatever the root cause, there has always been a tradition of larger, more powerful parties profiting at the expense of the smaller party. This tradition persists to this day. It is an industry practice for contracts with one title to actually contain provisions, clauses, and mandates that do not fit within the boundaries of the contract title. It is also an industry practice for contract terms in a later contract to invalidate provisions from earlier contracts. This “trick” may be expressly spelled out in a paragraph. It may be hidden within an “entirety” clause, which is a clause stating the present contract between the parties is the whole agreement and all previous agreements are rescinded and invalid (boilerplate language with a punch!)

It is an industry practice for contracts with one title to actually contain provisions, clauses, and mandates that do not fit within the boundaries of the contract title. It is also an industry practice for contract terms in a later contract to invalidate provisions from earlier contracts. This “trick” may be expressly spelled out in a paragraph. It may be hidden within an “entirety” clause, which is a clause stating the present contract between the parties is the whole agreement and all previous agreements are rescinded and invalid (boilerplate language with a punch!) Know all the categories of people to whom you will be discussing in advance. Try not to miss anyone.

Know all the categories of people to whom you will be discussing in advance. Try not to miss anyone. Reality Check: Do not expect a venture capital or other investor to sign a confidentiality agreement or a non-disclosure agreement. First, they feel that if it is necessary for you to disclose your confidential business secrets just to earn an investor, then the information and documents really are not “secrets” and it is not worth their money. Second, investors, especially venture capital investors see many proposals. They cannot be put in the position of having so many contracts “lording over them” as it creates a legal jungle. Luckily, the business risk of an investor or other venture capitalist disclosing your confidential business secrets in the absence of a non-disclosure agreement is small. If a venture capitalist had a reputation of disclosing to competitors, that investor would not be in business for long!

Reality Check: Do not expect a venture capital or other investor to sign a confidentiality agreement or a non-disclosure agreement. First, they feel that if it is necessary for you to disclose your confidential business secrets just to earn an investor, then the information and documents really are not “secrets” and it is not worth their money. Second, investors, especially venture capital investors see many proposals. They cannot be put in the position of having so many contracts “lording over them” as it creates a legal jungle. Luckily, the business risk of an investor or other venture capitalist disclosing your confidential business secrets in the absence of a non-disclosure agreement is small. If a venture capitalist had a reputation of disclosing to competitors, that investor would not be in business for long! Explore whether the party to whom you are going to share your confidential information will share this information (intentionally or unwittingly) with persons or entities not a party to your non-disclosure agreement. Examples include:

Explore whether the party to whom you are going to share your confidential information will share this information (intentionally or unwittingly) with persons or entities not a party to your non-disclosure agreement. Examples include: Make a list of the various categories of business secrets and confidential information you must protect. Make your list specific. Make your list complete. This is important for two reasons.

Make a list of the various categories of business secrets and confidential information you must protect. Make your list specific. Make your list complete. This is important for two reasons. First, the other party to the contract will be unable to figure out what they are supposed to keep secret and what they can disclose. So, though well meaning, the attorneys who drafted those non-disclosure agreements have put their clients in an untenable position.

First, the other party to the contract will be unable to figure out what they are supposed to keep secret and what they can disclose. So, though well meaning, the attorneys who drafted those non-disclosure agreements have put their clients in an untenable position.

There are exceptions when confidential information must be disclosed. Make sure your non-disclosure agreement carves out these exceptions to your definition of business secrets so that the lack of a carve out does not spoil other portions of the non-disclosure agreement. These include:

There are exceptions when confidential information must be disclosed. Make sure your non-disclosure agreement carves out these exceptions to your definition of business secrets so that the lack of a carve out does not spoil other portions of the non-disclosure agreement. These include: To address these risks, make sure your NDA lawyer drafts a specific conspicuous clause in the non-disclosure agreement that the other party has a duty to provide notice of any legal obligation to disclose. There should also be written in a time period to raise objections for a legal process requiring disclosure.

To address these risks, make sure your NDA lawyer drafts a specific conspicuous clause in the non-disclosure agreement that the other party has a duty to provide notice of any legal obligation to disclose. There should also be written in a time period to raise objections for a legal process requiring disclosure. There are economic realities that harm businesses through the disclosure of confidential business information but still prevent a practical remedy because of the time and cost of litigation. Make sure you discuss various remedy provisions within the non-disclosure agreement. These include:

There are economic realities that harm businesses through the disclosure of confidential business information but still prevent a practical remedy because of the time and cost of litigation. Make sure you discuss various remedy provisions within the non-disclosure agreement. These include: There are rules, known as “Choice of Laws” provisions and “Venue” statutes that determine the physical location of any dispute. Venue can be the location of the parties. It can be the location of where the “bad act” occurred. It can be the location of where the damage occurred.

There are rules, known as “Choice of Laws” provisions and “Venue” statutes that determine the physical location of any dispute. Venue can be the location of the parties. It can be the location of where the “bad act” occurred. It can be the location of where the damage occurred. Contract laws can permit arbitration or mandate any disputes be decided by a court of law. Prepare to discuss in advance the benefits and detriments of arbitration with your non-disclosure agreement attorney so you may decide whether to include an arbitration provision.

Contract laws can permit arbitration or mandate any disputes be decided by a court of law. Prepare to discuss in advance the benefits and detriments of arbitration with your non-disclosure agreement attorney so you may decide whether to include an arbitration provision. Few relationships last forever. It is likely your business relationship with this other entity will at some point end. At that time, the issue will arise. What should be done with the confidential information shared between the parties? Choices include:

Few relationships last forever. It is likely your business relationship with this other entity will at some point end. At that time, the issue will arise. What should be done with the confidential information shared between the parties? Choices include: Watch out for proposed provisions that may result in a transfer of ownership of proprietary information. For example, a provision that a party disclosing a document will own any and all information in that document may give the counterparty an argument that it owns your information because it disclosed a document containing your information to you. The NDA should address which party will own any intellectual property derived from information disclosed by the parties (assuming the NDA contemplates the creation of intellectual property).

Watch out for proposed provisions that may result in a transfer of ownership of proprietary information. For example, a provision that a party disclosing a document will own any and all information in that document may give the counterparty an argument that it owns your information because it disclosed a document containing your information to you. The NDA should address which party will own any intellectual property derived from information disclosed by the parties (assuming the NDA contemplates the creation of intellectual property).