14 DAO Issues You Must Consider Before Incorporating

14 DAO Issues You Must Consider Before Incorporating

1. Does the DAO Need to Be Incorporated, At All?

A “legal wrapper” for a decentralized autonomous organization is a compromise in philosophy. The legal wrapper adds centralized entity utility to a decentralized entity regardless of whether it is a Trust, an LLC, or another entity type.

A “legal wrapper” for a decentralized autonomous organization is a compromise in philosophy. The legal wrapper adds centralized entity utility to a decentralized entity regardless of whether it is a Trust, an LLC, or another entity type.

A DAO legal wrapper improves the functioning of the DAO. The wrapper limits many undesirable risks. However, a DAO legal wrapper costs money in legal fees. It costs time for those managing the DAO.

What are the Benefits of a DAO Legal Wrapper?

What are the Benefits of a DAO Legal Wrapper?

Formal incorporation by a DAO increases the range of its interactions with the rest of the world. Incorporation increases the ease of those interactions. These functions include:

- Having a Bank Account

- Easier Financial Transactions

- Having Representation in a Court of Law

- Getting a Loan

- Increased confidence about where will be the DAOs tax liability

- Paying Taxes (Pass-Through Deduction) (Tax Cuts and Jobs Act 20% deduction)

- Efficient Interactions with Regulators

Does a DAO Legal Wrapper Reduce Risks?

DAO members often fail to realize the risks they take when the DAO is unincorporated. These risks include:

DAO members often fail to realize the risks they take when the DAO is unincorporated. These risks include:

- Higher Tax Rate (Double taxation) (Federal Withholding Tax for foreign nationals)

- DAO members getting personally sued

- DAO members being legally liable for negligence in which they played no part

- DAO members personally liable for all DAO debts

- Losing personal assets because of a lawsuit against the DAO but not them

- Punishment by regulators and other legal authorities because of a lack of clear interaction with the DAO

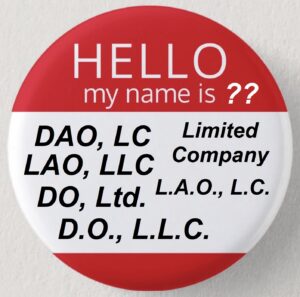

2. What Will Be the Formal Legal Name for the Decentralized Autonomous Organization?

Your DAO will need to choose a formal legal name that complies with its State of Incorporation. Decentralized Autonomous Organizations are now called by a number of different names, because a State Law has included the name in its definition.

People love making labels. Sometimes the person making the new label seeks to make a better label. Other times, the person making the new label seeks to avoid a problem with the original label. Let’s face it; many people love renaming just so they can say “I invented the ________!” And … who loves unearned credit more than a politician? So, the list of DAO names now includes:

People love making labels. Sometimes the person making the new label seeks to make a better label. Other times, the person making the new label seeks to avoid a problem with the original label. Let’s face it; many people love renaming just so they can say “I invented the ________!” And … who loves unearned credit more than a politician? So, the list of DAO names now includes:

- DAO Decentralized Autonomous Organization

- LAO Limited Liability Autonomous Organization

- DO Decentralized Organization

Specific (required) Names even add complexity!

- DO LLC

- DAO LC or LAO LC

- DAO L.C. or LAO L.C.

- DAO LLC or LAO LLC

- DAO L.L.C. or LAO L.L.C.

- DAO Limited Company or LAO Limited Company

- DAO Limited Liability Co. or LAO Limited Liability Co

- DAO Limited Liability Company or DAO Limited Liability Company

The formal legal name for the DAO will be its name, plus one of the State law phrases above. An example would be “Electro Optical System DAO, L.C.”

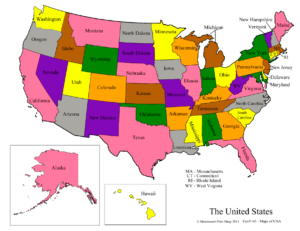

3. Do You Want Be Under a Specialized DAO Law?

The States have begun to enact DAO specific laws to recognize them as entities, and provide a framework for DAO operations. Each embodies a State intent to promote DAO and Web3 business within its borders. The laws are presently coded as:

The States have begun to enact DAO specific laws to recognize them as entities, and provide a framework for DAO operations. Each embodies a State intent to promote DAO and Web3 business within its borders. The laws are presently coded as:

- Wyoming “Wyoming Decentralized Autonomous Organization Supplement”

- Vermont “Blockchain-Based Limited Liability Companies”

- Tennessee “DO LLC” or “Tenn. Code Ann. 48-250-101, et. seq.”

Wyoming enacted a special DAO incorporation law in April 2021, and amended in March 2022. A decentralized autonomous organization can be officially recognized as an entity under Wyoming law with this Senate Bill 38. This is not a requirement. The specialized U.S. State DAO laws are supplements to each State’s corporation laws. The specialized DAO law supersedes (is superior to and controls) State laws that conflict or are less specific. This specialized, dominant State law status adds clarity and legitimacy to DAO operations.

Yet, a DAO can be incorporated as a Trust, a regular LLC, a C-corporation, and other entity forms. This latter choice will be preferable to certain types of DAOs.

Is there a Way Around the DAO Specific State Incorporation Laws?

Remember, the DAO is not necessarily limited to choosing between these State laws. First, a framework can be created to incorporate the DAO under existing LLC laws. Though that is a more involved process, it can produce significant material advantages. Second, a DAO may incorporate through the laws of another country. This option should always be considered.

4. Will the DAO Need an Operating License?

Certain types of businesses require a license to operate. DAO members do not want to be accused of operating without a license. It creates criminal prosecution risk. It created civil government action risk. It opens the DAO and DAO members to lawsuits. DAO activities that may require a license include:

Certain types of businesses require a license to operate. DAO members do not want to be accused of operating without a license. It creates criminal prosecution risk. It created civil government action risk. It opens the DAO and DAO members to lawsuits. DAO activities that may require a license include:

- Intellectual property

- Some types of Services,

- Selling Payment Instruments

- Issuing Payment Instruments

- Receiving Money or monetary value

- Exchanging Cryptocurrency (primary, secondary, or third party transferring, selling, purchasing, or issuing)

- Maintaining a Digital Wallet (sometimes) (some jurisdictions have a net worth minimum requirement)

- Operating ATMs

- Selling or Issuing Checks

- Transferring Ownership of various types of assets

The type of DAO activities will influence whether a license will be needed, and the type of license. Jurisdiction (location) of formation becomes important as requirements differ from location to location. Also, the location of where the clients will be and where business will occur is important for licensing issues. The minimum time to receive a license can vary from a few days to 9 months or longer. Minimum capital requirements can range from 5 cents to over $750,000.00. License costs vary from as low as $133.00 to as high as $53,000.00.

5. Does the DAO Need a Specific Corporate Location?

The location in which a DAO is legally formed created the legal framework for the entire DAO. This makes DAO location choice a critical decision. The DAO becomes a legal, separate entity according to that jurisdiction’s laws irrespective of what its smart contract, operating agreement, or protocols may mandate.

The location in which a DAO is legally formed created the legal framework for the entire DAO. This makes DAO location choice a critical decision. The DAO becomes a legal, separate entity according to that jurisdiction’s laws irrespective of what its smart contract, operating agreement, or protocols may mandate.

The Location of Incorporation the DAO chooses should take into consideration all the factors that location influences. These factors include:

- Tax treatment

- Venue: The location where the law can be sued

- Choice of Laws: What laws will apply to the DAO

- Regulatory certainty: Some DAOs benefit from ambiguous DAO laws. Other DAOs benefit from regulatory specificity and certainty.

- Employee location: DAOs can have employees that are not DAO voting members. Those employees will be in a particular location. Employee interaction will benefit from being incorporated in a location familiar to the DAO employees.

- DAO member locations: DAOs are governed largely by their contributing members. Those members will benefit from familiarity with the issues the DAO faces. Being incorporated in a familiar location will assist that decision familiarity.

- Government Stability: Many countries have set up web3 laws to entice business to locate there. Web3 companies have seen “rug pull” like behavior from enticing countries. For example, a number of countries have passed laws with highly reduced taxes to lure web3 business, only to later scale back the legal benefits. Location of incorporation is a long term decision for a DAO, and the stability of what the government is offering matters.

6. What Will Be the Requirements to be a DAO Member?

There are a number of options for an individual to become a contributing DAO “member.” Member options can be:

There are a number of options for an individual to become a contributing DAO “member.” Member options can be:

- Defined in the Operating Agreement

- A transaction (a token purchase)(Article 10 of Wyoming’s LLC Chapter)

- Designation by a former member

- Designation by the legal representative of a former member

- Consent by the present DAO members

- Defined by the DAO governing Smart Contract

DAO member requirements are a mandatory decision that must be vetted in advance of formation. The formation documents must spell out voting DAO member requirements.

7. For How Long Does the DAO Intend to Exist?

Some organizations are created for a specific task, to respond to a specific need, to respond to a specific threat, or simply for a set time period.

DAOs Limited by Time or an Event:

DAOs Limited by Time or an Event:

- For example, the March of Dimes was created to eradicate polio, which it effectively achieved.

- For example, a DAO could be created to respond to cleanup after a hurricane.

- For example, a political DAO could be created to elect a particular candidate.

- For example, a DAO could be created to facilitate a fork in a blockchain from proof of work to proof of stake.

These would be DAOs limited in time. For these DAOs, it is necessary to precisely define what event or what period of time will cause the DAO to cease.

Most organizations are perpetual, intended to last indefinitely. These organizations are usually created to work on a problem with no particular solution.

Immortal DAOs:

Immortal DAOs:

- For example, a DAO could be created to fight racism

- For example, a DAO could be created to make profits using liquidity mining.

- For example, a DAO could be created as a Trust to help the interests of a particular family, or closely defined group

These are perpetual DAOs. The incorporation documents must detail whether the DAO will be mortal (and the circumstances of its mortality), or immortal.

8. Does the DAO Wish to Have a Delayed Formation Date?

Most organizations, when formed, intend to start operating immediately. However, a DAO may have good reasons to file its necessary paperwork, but still delay its official formation. For example:

Most organizations, when formed, intend to start operating immediately. However, a DAO may have good reasons to file its necessary paperwork, but still delay its official formation. For example:

- Delaying for the Next Tax Year

- Delaying for the Receipt of Investment Funds

- Delaying for Protocol Completion

- Delaying for an important Membership Vote

If formation delay is needed, most States have a procedure of either naming a formation start date, or leaving a formation date box blank. Remember: there are legal requirements on how much delay is allowed (like 90 days in Wyoming).

9. Will the DAO Members be Fiduciaries?

The DAO must decide whether voting members or any employees will be fiduciaries. A fiduciary is more than just a power of attorney or agent, someone acting on behalf of the DAO. A DAO fiduciary has a duty to act on behalf of the DAO, even when those actions harm the fiduciary. Traditional fiduciaries include:

The DAO must decide whether voting members or any employees will be fiduciaries. A fiduciary is more than just a power of attorney or agent, someone acting on behalf of the DAO. A DAO fiduciary has a duty to act on behalf of the DAO, even when those actions harm the fiduciary. Traditional fiduciaries include:

- A Lawyer for his Client

- The Trustee of a Trust

- An Executor of an Estate

- A Stock Promoter to Investors

- A Corporate Executive Officer to the Company

- An Insurer to it Insured

In the example of a DAO, there may be many voting DAO members. It may be difficult to police DAO member activities. Yet, in the absence of fiduciary status, a DAO member may:

- Fail to act prudently in their DAO responsibilities

- Compete against the DAO

- Use secret DAO information for individual profit, though it costs the DAO

- Benefit DAO competitors

- Interfere with DAO suppliers and collaborators

- Publicly disclose private DAO information

- Vote for DAO activities that create unreasonable risk

The laws of Tennessee and Wyoming do not require DAO members to be DAO fiduciaries. Other jurisdictions require DAO member fiduciary status. Deciding the issue of who is and will not be a DAO fiduciary will affect the manner in which the DAO is incorporated.

10. Will the DAO be Member-Managed or Algorithmically Managed?

The U.S. State law presumption is that a DAO is Member Managed, if not otherwise stated. This State law requirement is a bit of a false distinction. Namely, whether the DAO is member-managed or algorithm managed (Tennessee). The truth is: every DAOs is an interplay and mix of member and algorithm management.

The U.S. State law presumption is that a DAO is Member Managed, if not otherwise stated. This State law requirement is a bit of a false distinction. Namely, whether the DAO is member-managed or algorithm managed (Tennessee). The truth is: every DAOs is an interplay and mix of member and algorithm management.

Still a decision needs to be made. How will the smart contracts be programmed? Factors that influence this decision include:

- What will be the power interplay between DAO members and DAO corporate members?

- What rights do DAO smart contract members have?

- What rights do DAO corporate members have?

- What are the obligations / duties of DAO smart contract and corporate members?

- How is DAO membership to be transferred?

- How can a DAO member quit?

- How will DAO profits and losses be distributed?

- What will be the procedure to amend the DAO’s legal terms?

- What will be the procedure to amend the smart contract (protocols) of the DAO?

These power-based decisions must be considered before formal entity formation occurs. Each jurisdiction requires the disclosure of these answers.

Manager Management: DAO Blasphemy … But An Option

Manager Management: DAO Blasphemy … But An Option

There is a third option if the DAO elects to be incorporated, not under a DAO specific State law, but under a general State incorporation statute. In that case, a DAO can be Manager Managed. Central Manager management is contrary to the core concept of a DAO, a decentralized autonomous organization being truly centrally controlled. However, this is an option with its own benefits and deficits. It is possible to have a centrally managed DAO corporate legal wrapper with an underlying decentralized autonomous organization. Weird. Crazy. Blasphemous! Possible.

11. How Frequent Will Your DAO be Active?

The frequency of DAO activity must be weighed in its entity formation. Some state laws, such as Wyoming and Tennessee, mandate that a DAO approve a proposal or take an action each year. Otherwise, the DAO dissolves. One could form a DAO to deal with an event that infrequently happens. One could form a DAO for an unlikely event. For example:

- A DAO to deal with a financial crises (debt restructuring, mortgage failures, inflation)

- A DAO to deal with a humanitarian crises (hurricanes, floods, disease pandemic)

- A DAO to deal with a governmental crises (currency devaluation, failure to form a government coalition, overthrow)

A DAO expecting an infrequent or unlikely activity trigger should choose a jurisdiction of formation without a minimum yearly activity requirement.

12. How Difficult Will It Be to Reach a Voting Quorum?

Member participation and voting often has a low rate for DAOs, especially for mundane tasks. This can be a real problem if the DAO is incorporated in a State that mandates a majority quorum. Some states require a majority quorum for a valid DAO vote (Tennessee). Other jurisdictions allow quorum voting requirements to be defined in the DAO Operating Agreement.

Member participation and voting often has a low rate for DAOs, especially for mundane tasks. This can be a real problem if the DAO is incorporated in a State that mandates a majority quorum. Some states require a majority quorum for a valid DAO vote (Tennessee). Other jurisdictions allow quorum voting requirements to be defined in the DAO Operating Agreement.

No DAO decision will be valid if a quorum does not participate. Any DAO decision may later be nullified if it is shown that a quorum was not reached. What is more, in jurisdictions where DAO members or employees are fiduciaries, they may be personally sued for making valid DAO decisions without a valid quorum. All these problems can be avoided by (1) determining whether a majority quorum problem will exist, and (2), if so, avoiding incorporating in a jurisdiction where a majority quorum is mandated.

13. Is It Best for the DAO to Subject Itself to the Added Legal DAO requirements?

How important will legal legitimacy be for the DAO? What degree of legal work will the DAO willingly endure? The answers to these questions relate to one another. Most DAO legal requirements are identical to those of regular Trusts, LLC, C-Corporations, and other entities. However, DAO specific laws and entities have been created by various governments. These specific laws and entities better fit the DAO, but have added expenses and requirements. The decision needs to be made.

Is your DAO a best fit for a new DAO specific entity and its laws or is your DAO better suited for the traditional entity rules?

Many DAO Incorporation Requirements Are Identical to a Limited Liability Corporation (LLC)

DAOs under these new U.S. State laws are incorporated much as LLCs. The DAO must name its “Organizers.” These are the people, like a corporate executive committee, who are submitting the DAO formation paperwork. An organizer does not necessarily have to be a DAO Member. The DAO files Articles of Incorporation. The DAO adopts an Operating Agreement. The DAO gets a tax identification number. There is a local DAO registered agent. The Dao will have an official mailing address. This address can sometimes be anywhere on Earth; other times the address must be in the State of formation. The DAO will have an official telephone number (usually must be in the country of formation). The DAO will have an official email address. The DAO will pay a registration fee (approximately $100-$300, depending upon the State). Some DAO registrations can be online. Other DAO registrations need to be mailed in. For example, DAOs with punctuation in their name have a mail in requirement. DAOs with “the,” “and,” or “an” in the name must be mailed in.

There Are Added Incorporation Requirements Just for DAOs

A State-recognized decentralized autonomous organization will have added burdens not imposed upon other LLCs, Trusts, and Corporations. For example:

A State-recognized decentralized autonomous organization will have added burdens not imposed upon other LLCs, Trusts, and Corporations. For example:

- The official name of the DAO must have specific language, such as including “DAO LLC.”

- How will the DAO be managed by its members (Wyoming)?

- The extent of algorithmic management (Wyoming).

- A disclaimer in the operating agreement or articles of incorporation

- The Articles of Incorporation must contain a public key of the current DAO smart contract (Wyoming, Tennessee)

- A DAO must include a summary of its mission/purpose in its operating agreement (Vermont).

- A DAO must include specifics about how the blockchain will be used in its DAO operations (Vermont).

- DAO protocols must be disclosed for security breach responses.

- Voting procedures must be disclosed.

- Member qualifications must be disclosed.

- DAO participant rights and duties must be disclosed.

- The DAO governing smart contract must be capable of being updated, modified, or upgraded (Wyoming, Tennessee) (which is a problem for anyone familiar with blockchain smart contract programming)

14. Will the DAO be issuing Tokens or Cryptocurrency?

A tiered, specialized legal structure is likely needed for any DAO that issues a crypto token. This is needed to comply with legal-regulatory mandates. This is needed to protect the DAO and its members from legal liability. This is needed to protect investors. There are tax issues that increase the need. Paying employees can be an issue. Banking may be an issue.

A tiered, specialized legal structure is likely needed for any DAO that issues a crypto token. This is needed to comply with legal-regulatory mandates. This is needed to protect the DAO and its members from legal liability. This is needed to protect investors. There are tax issues that increase the need. Paying employees can be an issue. Banking may be an issue.

There are two common ways that a crypto token is issued:

- A Public Token Offering ICO (Initial Exchange Offering) ISO Initial Stake Offering, Etc.

- A Venture Capital Firm (Using a SAFE or a SAFT) (a legal entity will be needed to agree to these contracts)

There are issues whether the Token is considered a security or a commodity. There are AML (Anti Money Laundering) and KYC (Know Your Customer) issues. Some locations (countries) may have to be avoided for legal reasons (U.S., China, Cayman Islands).

Legal entities need to be separated. Specifically, one entity may be used to put the crypto token to market. A second entity may be operations (coding, banking, employee services). A third entity may be needed for regulation risky jurisdictions (China, United States, Etc.).

A Panama Private Interest Foundation is frequently formed for the token offering. Singapore is also an option. That PPIF entity pays the other entities (the receiving entities bridge the crypto to fiat, paying employees and investors). The point is to separate the banking, token offering, and operations to reduce risk, and target the regulatory location.

The Crypto Lawyers at Whale.Law advise client on issues relating to decentralized autonomous organizations. We guide them through the process of DAO “legal wrapped” formation. Our blockchain attorneys do the hard work to add business value and reduce risk. Contact us once you have thought through the above issues.