A Raymore, Belton and Harrisonville trial lawyer will find the following legal memorandum helpful as an outline of property damage lawsuits that will go to trial.

Cass County, Missouri attorneys will be assisted from analyzing this memorandum as it gives the inside perspective of the insurance company and it Cass County attorneys. The analysis used will be the same as other similar lawsuits.

The analysis is helpful for Harrisonville, Cass County, Missouri Breach of Contract and civil Fraud cases. Names and identifying information has been changed to protect the privacy of the litigants involved.

Questions regarding large property damage claims should be directed to our Cass County law firm. 816-540-2161.

December 6, 2011

VIA FACSIMILE AND U.S. MAIL

Mr. Vance Prewitt

200 Belton Plaza

4330 Belleview

Raymore, MO 64083

Fax: 816/540-3147

Re: Lee’s Summit Services, Inc. v. Harrisonville Grocery, Inc.

Policy No.: 3214-70-15

Our Claim No.: 06040-25789

Date of Loss: 6/23/2008

Dear Mr. Prewitt:

We have had the opportunity to review and summarize the facts and law in this case in detail. I have set forth our findings in detail below. This summary should assist you through the mediation process.

CASS COUNTY ATTORNEY

STATEMENT OF THE CASE

This lawsuit arises out of the collapse of a roof at 400 Atlantic Avenue, Harrisonville, Cass County, Missouri on June 23, 2008. There are two defendants in this action, Harrisonville Grocery, Inc. (hereinafter “Harrisonville Grocery”), and Raymore Contracting, Inc.. Defendant Harrisonville Grocery is a former owner of the building that sold the property to Chris and Scott Mueller. Harrisonville Grocery is represented by Matthew J. Hamilton, a Belton/Raymore personal injury attorney (auto accident). Defendant Raymore Contracting, Inc. is a company that performs roof repairs. It was contracted by defendant Harrisonville Grocery on several occasions to repair water leaks in the building. Raymore Contracting, Inc. is represented by Jennifer L. Grove of Peculiar, MO.

Plaintiff Lee’s Summit Services, Inc. (hereinafter “Lee’s Summit”) is a Missouri corporation owned by Chris and Scott Mueller. Chris and Scott Mueller have executed a contract which purports to assign their rights to sue in this matter to Lee’s Summit. Lee’s Summit Services is represented by Rich Livingston, Harrisonville personal injury lawyers.

Plaintiff Euro International Group (hereinafter “EIG”) is a Missouri corporation that was a tenant in the building at the time of the roof collapse. EIG is represented by Joe Hamilton, a Pleasant Hill auto accident lawyer.

Defendant Harrisonville Grocery is a prior owner of the property at 400 Atlantic Avenue, Harrisonville, Cass County, Missouri. On February 16, 2008 plaintiff EIG entered into a lease agreement with Harrisonville Grocery. Plaintiff EIG agreed in section twenty-five of said agreement that it would release parties, such as the defendant Harrisonville Grocery, from liability for property damage by any casualty, such as the damage alleged in plaintiff’s Petition, if the plaintiff was carrying insurance for said loss. EIG has acknowledged that it was carrying insurance covering the property for which it seeks recovery in this case.

Records and deposition testimony provided by Raymore Contracting reflect that its workers, Sonny Illig and Sean Ireland, were called out to Harrisonville Grocery on four occasions. On January 11, 2008, Raymore Contracting located and fixed four leaks in the northwest corner of Harrisonville Grocery’s building. They also found, patched and repaired numerous field seams in the roofing membrane; and caulked and patched a number of scuppers in the northwest corner of the building. On February 1, 2008, they checked on their repairs to the roof and noted no additional leaks at that time. On February 22, 2008, Raymore states that Harrisonville Grocery hired the company to find and repair leaks in the northwest corner of the building. Upon arriving, Raymore workers found water ponded in the northwest corner of the roof. The workers believed the leaks were coming from additional breaches in the field seams of the roof’s membrane. Those areas were patched and repaired.

Raymore Contracting took several photographs of the roof on its visits to Harrisonville Grocery’ building. The pictures show the repair work completed by the men. One of pictures even documents a roofer for Raymore Contracting standing in the ponded water on the northwest corner of the roof. From the pictures, it does not appear that the professional roof repairmen of Raymore Contracting noticed any signs that the roof might collapse.

On or about March 11, 2008, a Real Estate Sale Contract was executed wherein defendant Harrisonville Grocery conveyed the aforementioned property to Chris and Scott Mueller. Under the contracts in the sale, plaintiff EIG became the tenant of Chris and Scott Mueller.

On approximately March 20, 2008, workers for Raymore Contracting were again called out and repaired additional leaks in the northwest corner of the building. Over three months later, on June 23, 1998, a large strong rain storm hit the Harrisonville, Cass County, Missouri area. During the rain storm, the roof of the building collapsed.

Lee’s Summit is currently making the following claims against Harrisonville Grocery. It claims that Harrisonville Grocery breached its real estate sale contract and escrow agreement with them by failing to repair or make financial provisions to repair the roof. Lee’s Summit claims that Harrisonville Grocery represented in these contracts that the roof had been adequately and sufficiently repaired. Lee’s Summit also claims that Harrisonville Grocery represented that it would repair any remaining roof leaks. In addition, Lee’s Summit claims that our client negligently maintained the building prior to the sale and should have known that the leaks would saturate the insulation and cause water ponding on the roof. It claims that the roof leaks saturated the insulation board underneath the roof, causing an excessive load on the structure which led to the roof’s collapse. Lee’s Summit claims approximately $1,100,786.70 in damages.

The Petition for Damages of plaintiff EIG against Harrisonville Grocery alleges counts of negligence and breach of contract. EIG claims that Harrisonville Grocery represented to EIG, during its ownership of the building, that the roof leaks and ponding would be corrected. It claims that these representations amounted to an oral agreement to make the repairs. EIG also claims that Harrisonville Grocery owed them a duty of care to maintain and repair the roof. The company asserts that the promised repairs were not made and that the failure to repair led to the roof collapse. Plaintiff EIG seeks damages for repairs, inventory damages, loss of business and consequential damages allegedly sustained because of the collapse. EIG claims approximately $406,602.51 in damages. The plaintiff EIG made a claim and was paid by its property casualty insurance carrier for its losses in the collapse.

SUPPORTING LAW

HARRISONVILLE TRIAL ATTORNEY ANALYSIS

1. It is unlikely that Lee’s Summit Service’s negligence claim will succeed because Harrisonville Grocery owed no duty to inspect, repair or maintain the property after it was sold.

There is presently no indication that defendant Harrisonville Grocery had a duty to prevent the roof collapse because other parties owned, possessed and controlled the property when the collapse occurred. Plaintiffs must show the presence of a duty in order to maintain a negligence claim. Mediq PRN Life Support Services, Inc. v. Abrams, 899 S.W.2d 101, 109 (Mo.App. E.D. 1994). In Missouri, lessors have no duty to inspect, repair or keep property in a reasonably safe condition unless they retain possession and control over the property or sign contracts creating such duties. Dean v. Gruber, 978 S.W.2d 501, 503 (Mo.App. W.D. 1998); Stark v. Lehndorff Traders Venture, 939 S.W.2d 43, 45 (Mo.App. W.D. 1997). As the Missouri Supreme Court has stated:

[I]n instances where ownership or possession changes during the useful life of the real property, the common law generally affords protection to former owners and occupiers as opposed to persons owning or occupying at the time of injury. The common law seldom results in liability for former owners or operators who are not connected to the property at the time of the injury.

Blaske v. Smith & Entzeroth, Inc., 821 S.W.2d 822, 830 (Mo. 1991).

Here, the Muellers closed on the property on May 1, 2008. At the time of the collapse, Harrisonville Grocery did not possess or control the property. Consequently, Harrisonville Grocery had no duty to inspect, repair or keep the property in a reasonably safe condition. Plaintiffs’ negligence claim cannot be proven without evidence of a duty to the property.

2. There is presently no indication that Harrisonville Grocery made fraudulent representations to Lee’s Summit Services.

The fraudulent representation claims of plaintiff Lee’s Summit Services are not supported by evidence at the present time. The elements of a submissible case of fraud in Missouri are: (1) a false material representation; (2) the speaker’s knowledge of its falsity or its ignorance of its truth; (3) the speaker’s intent that it should be acted upon by the hearer in the Muellerer reasonably contemplated; (4) the hearer’s ignorance of the falsity of the statement; (5) the hearer’s reliance on its truth, and the right to rely thereon; and (6) proximate injury. Mobley v. Copeland, 828 S.W.2d 717, 724 (Mo.App. 1992). Specifically, fraudulent representations arise from two events, either an affirmative misrepresentation was made or passive non-disclosure occurred. Affirmative misrepresentations may be either completely false or half-truths which convey or create the same impression. Maples v. Charles Burt Realtor, Inc., 690 S.W.2d 202, 209 (Mo.App. 1985). Here, there is no evidence that Harrisonville Grocery should have suspected that the roof would collapse. The roof showed no problems other than occasional roof leaks, which had occurred for years. Harrisonville Grocery hired Raymore Contracting, which sent professional roof repairmen to the property to repair the leaks when they occurred. These roofers detected no sign that the roof could collapse on the multiple occasions they visited the site. They detected no risks even when standing in the area where the roof collapsed. Further, Lee’s Summit Services will have difficulty showing that they did not know of the roof problems that were detectable. They will also have difficulty proving that they both had the right to and did rely on the roof’s good condition. This is because Lee’s Summit Services inspected and accepted the condition of the roof prior to the sale of the building. They also signed contracts stating that they accepted the condition of the roof. Thus, there is presently no evidence to support several elements of Lee’s Summit Services’ fraudulent representation claim against Harrisonville Grocery.

3. Harrisonville Grocery will not be liable for fraudulent representations based upon a failure to disclose.

Lee’s Summit Services claims that Harrisonville Grocery failed to disclose the leaky nature of the roof. It is unlikely that these claims can succeed. This is because (1) the sale was made “as is,” (2) Lee’s Summit Services inspected the premises and (3) Lee’s Summit Services approved of the premises. Generally, “fraud will not lie for tacit non-disclosure.” Blaine v. J.E. Jones Constr. Co., 841 S.W.2d 703, 706 (Mo.App. 1992). However, a duty to disclose does arise “when a classical fiduciary relationship exists or where one party has superior knowledge which is not within the fair and reasonable reach of the other party.” Ringstreet Northcrest, Inc. v. Bisanz, 890 S.W.2d 713, 720 (Mo.App. W.D. 1995); Blaine, 841 S.W.2d at 705. Missouri courts look to an open-ended list of factors to determine whether a duty to disclose exists. Ringstreet Northcrest, Inc., 890 S.W.2d at 721; Blaine, 841 S.W.2d at 707. Specifically, the courts emphasize the relative intelligence of the parties to the transaction, the relation the parties bear to each other, the nature of the fact not disclosed, the nature of the contract, whether the alleged concealer is a buyer or seller, the importance of the fact not disclosed and the respective knowledge and means of acquiring knowledge of the parties. Id. We have checked with our Lee’s Summit personal injury lawyers and they concur with this analysis.

Missouri courts have specifically stated that there is no duty to disclose defects where (1) the property was sold “as is,” (2) the buyer was informed of the building’s prior problems, (3) the buyer inspected the premises, and (4) the transaction was between businesses. Ringstreet, 890 S.W.2d at 724. Furthermore, Missouri courts hold that a non-fiduciary party to a contract has no duty to disclose facts “that normally can be ascertained by a reasonable inquiry.” Blaine, 841 S.W.2d at 708; Fairmont Foods Co. v. Skelly Oil Co., 616 S.W.2d 548, 550-51 (Mo.App. 1981); Barylski v. Andrews, 439 S.W.2d 536, 542 (Mo.App. 1969); see also Kansas City Downtown Minority Dev. Corp. v. Corrigan Assoc. Ltd. Ptr., 868 S.W.2d 210, 221 (Mo.App. W.D. 1994)(stating that the undisclosed fact must be undiscoverable in the exercise of due diligence). Here, no fiduciary relationship existed between Harrisonville Grocery and Lee’s Summit Services. The sales contracts show that the property was sold “as is.” The sales contracts also show that Lee’s Summit Services was informed of the roof’s prior water problems. Lee’s Summit Services inspected and accepted the premises. Lee’s Summit services is a business, not an individual. In addition, the known roof problems could be ascertained by a reasonable inquiry into the building’s history. Lee’s Summit Services will be unable to successfully claim fraudulent representations based on a duty to disclose for these reasons.

4. Defendant Harrisonville Grocery had no duty to plaintiff EIG.

Our Harrisonville personal injury attorneys have uncovered no indication that defendant Harrisonville Grocery owed a duty to plaintiff EIG in negligence. In Missouri, a plaintiff must present substantial evidence of every fact necessary to establish the liability of the defendant to present a submissible case of negligence. Hannah v. Mallinckrodt, Inc., 633 S.W.2d 723, 724 (Mo. banc 1982). In any negligence action, the plaintiff must establish (1) the existence of a duty on the part of the defendant to protect plaintiff from damage, (2) failure of the defendant to perform that duty, and (3) that plaintiff’s damage was proximately caused by defendant’s failure. Krause v. U.S. Truck Co., Inc., 787 S.W.2d 708, 710 (Mo. banc 1990). The existence of a duty is a matter of law and is thus a question for the court. Bunker v. Association of Missouri Electric Cooperatives, 839 S.W.2d 608, 611 (Mo.App. 1992). Plaintiff EIG must show a legal relationship between it and defendant Harrisonville Grocery that created a duty that was breached to prevail in its negligence claims. Here, the plaintiff states in its Petition that “defendant Harrisonville Grocery owed EIG a duty to exercise reasonable care and caution in maintaining and repairing the subject property….” This language, in essence, states that defendant Harrisonville Grocery had the duties of a landlord. Thus, plaintiff EIG must show a landlord/tenant relationship between it and Harrisonville Grocery to establish its alleged duties in negligence.

Our Harrisonville Attorney’s analysis indicates no landlord/tenant relationship existed between Harrisonville Grocery and plaintiff EIG at the time of the alleged loss. The traditional elements of a landlord-tenant relationship are: (1) an express or implied contract between the parties, (2) the creation of an estate in the tenant, either at will or for a specified term, (3) a reversion to the landlord, and (4) the transfer of exclusive possession and control to the tenant. Newcomb v. St. Louis Office for Mental Retardation & Developmental Disabilities Resources, 871 S.W.2d 71, 73-74 (Mo.App. 1994); Friend v. Gem International, Inc., 476 S.W.2d 134, 137-38 (Mo.App. 1972). Here, two of the required elements are missing from plaintiff EIG’s case. First, Harrisonville Grocery had sold the property and, thus, transferred EIG’s lease agreement (the contract) to the new owners, Chris and Scott Mueller before the time of the collapse. Second, there was no reversion at the end of tenant EIG’s lease to Harrisonville Grocery. At the end of the term of the plaintiff’s lease, the property would have reverted to Chris and Scott Mueller, not Harrisonville Grocery. Accordingly, no landlord/tenant relationship existed between the two parties at the time of the alleged loss. Defendant Harrisonville Grocery owed no duty to plaintiff EIG to maintain or repair the subject property at that time and plaintiff EIG lacks evidence to establish a duty in negligence.

5. Plaintiff EIG contractually waived its right to recovery in this case.

Our Harrisonville lawyer’s analysis indicates Plaintiff EIG, in its lease agreement, waived its right to recover from Harrisonville Grocery. Under Missouri law, no right of recovery for property damage exists on behalf of a lessee against a lessor when the lessee (1) agrees to waive its right to recover for property damage covered by casualty insurance, and (2) obtains casualty insurance for its property loss. Disabled Veterans Trust Co. v. Porterfield Construction, Inc., 996 S.W.2d 548, 552 (Mo.App. W.D. 1999).

Plaintiff EIG’s suit alleges that Harrisonville Grocery is liable for damage due to acts or neglect that are incident to the June 23, 1998 casualty. Once the property was sold and Defendant Harrisonville Grocery turned over possession and control of the property to Lee’s Summit Services, Harrisonville Grocery neither assumed nor owed any duties to EIG that related to the property. The acts or omissions alleged by EIG relate to when Harrisonville Grocery was its landlord. Assuming that Harrisonville Grocery had a duty to EIG, then Plaintiff EIG waived its right to recover from Defendant Harrisonville Grocery. The case of Porterfield, supra, had a nearly identical waiver of subrogation clause to the clause in this case. In Porterfield, the court held the clause to be an enforceable waiver of recovery rights. Here, the Lease between EIG and Harrisonville Grocery stated as follows:

As part of the consideration for this Lease, each of the parties hereby releases the other party hereto from all liability for damage due to any act or neglect of the other party (except as hereinafter provided) occasioned to property owned by said parties which is or might be incident to or the result of fire or any other casualty against loss for which either of the parties is now carrying or hereafter may carry insurance; provided, however, that the releases herein contained shall not apply to any loss or damage occasioned by intentional act of either of the parties hereto, and the parties hereto further covenant that any insurance that they obtain on their respective properties shall contain an appropriate provision whereby the insurance company, or companies, consent to the mutual release of liability contained in this paragraph.

Several of the original clauses to the lease were amended to allow Harrisonville Grocery to be liable in specific situations where it was negligent. No such changes were made to this clause. This indicates that the parties intended it to be enforceable as written. Further, several of the original clauses in the lease were crossed out and deleted when the parties did not intend for them to be a part of the contract. The above clause was not altered in any way. This also indicates that the parties intended for the clause to be enforceable.

Assuming that Defendant Harrisonville Grocery had duties to Plaintiff EIG, those duties arose because Harrisonville Grocery was a party to the lease. See infra. As such, defendant Harrisonville Grocery has the right to seek protection under its provisions. See Butler v. Mitchell-Hugeback, Inc., et al., 895 S.W.2d 15, 21 (Mo. banc 1995)(granting summary judgment on behalf of a third-party beneficiary to a contract that contained a waiver of recovery clause in a building collapse case). EIG was carrying insurance, and was in fact paid by its insurance carrier for that loss. EIG does not allege that that Harrisonville Grocery acted willfully, wantonly, or in a premeditated manner. As such, EIG has, in all likelihood, waived its right to recover against Harrisonville Grocery in this action, just as the lessee waived its right to recover against the lessor in Porterfield, supra.

6. No consideration could have supported the alleged contract between EIG and Harrisonville Grocery.

There is no indication of any consideration for the alleged oral contract that plaintiff EIG claims was breached. In Missouri, the essential elements of a contract are: (1) competency of the parties to contract; (2) subject matter; (3) legal consideration; (4) mutuality of agreement; and (5) mutuality of obligation. Hyatt v. Trans World Airlines, Inc., 943 S.W.2d 292, 296 (Mo.App. 1997); Shapiro v. Butterfield, 921 S.W.2d 649, 652 (Mo.App. 1996); Cash v. Benward, 873 S.W.2d 913, 916 (Mo.App. 1994). A valid contract must include an offer, an acceptance and consideration. Johnson v. McDonnell Douglas Corp., 745 S.W.2d 661, 662 (Mo. banc 1988). Here, plaintiff EIG claims that an oral contract to repair roof leaks, conditions causing leakage and to prevent ponding on the roof of a building was breached. The plaintiff has not pled that any consideration supported this alleged contract. There is no indication that any consideration did support the alleged contract. Id. Monthly lease payments were made to Harrisonville Grocery during the time that it was the building’s landlord. EIG has argued that signing the tenant estoppel certificate could be consideration for the alleged contract. However, the lease agreements were the consideration for the lease contract, not any alleged subsequent agreement. In addition, the tenant estoppel certificate was signed after the time that EIG alleges the oral contract was formed. Also, EIG has already alleged that the estoppel agreement was signed to facilitate the sale of the subject property, not as consideration to perform repairs on the property. As such, plaintiff EIG cannot succeed on its breach of contract claim under Missouri law according to the analysis of our Harrisonville auto accident law firm.

Moreover, if the plaintiff claims that Harrisonville Grocery had the duties of a landlord at the time the alleged contract was formed, then no consideration was present and no contract could have been formed. Landlords have duties to maintain and repair the common areas of the property. Dean v. Gruber, 978 S.W.2d 501, 503-04 (Mo.App. W.D. 1998). “[A] promise to do that which one is already legally obligated to do cannot serve as consideration for a contract.” Zipper v. Health Midwest, 978 S.W.2d 398, 416 (Mo.App. W.D. 1998); Wilson v. Midstate Industries, Inc., 777 S.W.2d 310, 314 (Mo.App. 1989) quoting City of Bellefontaine Neighbors v. J.J. Kelley R. & B. Co., 460 S.W.2d 298, 301 (Mo.App. 1970)). Here, plaintiff EIG claims that an oral contract to repair roof leaks, conditions causing leakage and to prevent ponding on the roof of a building was breached. If Harrisonville Grocery was the landlord of EIG at the time the alleged contract was formed, then Harrisonville Grocery would have already had these duties to the plaintiff. Therefore, the alleged contract would be based upon the pre-existing duties of Harrisonville Grocery and, again, no consideration would be present. No contract was formed.

I hope that this case summary will be of assistance to you during the mediation process. As always, if you have any questions or concerns or if you would like to discuss this matter further, please do not hesitate to call.

Very truly yours,

Matthew J. Hamilton

Pleasant Hill Cass County Personal Injury Lawyer

The Death of Your Claim – How to Preserve or Lose Your Judgment at the Ten Year Mark

The Death of Your Claim – How to Preserve or Lose Your Judgment at the Ten Year Mark Section 516.350 of the Revised Statutes of Missouri governs the revival of judgments. It indicates any judgment against a person (or entity) must be revived within ten years of its creation. The Court of Appeals in Unified CCR Partners v. Abright No. ED106082, 2018 WL295711 (Mo.App June 12, 2018) recounted the law in this matter. In order to revive a judgment, a party who receives the judgment may file a motion to “revive the judgment” within ten years of either the date of the judgment itself, or the date of the last revival. This was also expressed in Dummett v. Koster, 446 SW 3d 732, 734-35 (Mo. App. 2014). The important part is that the motion to revive must be filed within ten years of the Judgment or within ten years of the date of the last revival itself (if more than twenty years). The date of the last payment does not matter.

Section 516.350 of the Revised Statutes of Missouri governs the revival of judgments. It indicates any judgment against a person (or entity) must be revived within ten years of its creation. The Court of Appeals in Unified CCR Partners v. Abright No. ED106082, 2018 WL295711 (Mo.App June 12, 2018) recounted the law in this matter. In order to revive a judgment, a party who receives the judgment may file a motion to “revive the judgment” within ten years of either the date of the judgment itself, or the date of the last revival. This was also expressed in Dummett v. Koster, 446 SW 3d 732, 734-35 (Mo. App. 2014). The important part is that the motion to revive must be filed within ten years of the Judgment or within ten years of the date of the last revival itself (if more than twenty years). The date of the last payment does not matter. The plain language of Rule 74.09 requires that a party seeking a revival of their judgment, for example in a Lee’s Summit auto accident case, only needs to file a motion to revive the judgment and has to do nothing more within ten years of the judgment date itself. Abbott v. Abbott, Missouri Court of Appeals Western District case number 76525, 2013; reveals that arguments to the contrary have already been rejected by the courts in Wright Industries, Inc. v. New England Propellers Service, Inc., 881 SW 2d 243 (Mo. App. WD 1994). The court in Young Electric Sign Co. v. Duchell Furniture of Arizona, Inc., 9 SW 3d 685, 687 (Mo. App. 1999) reached a similar conclusion. There is no due diligence requirement upon the party making a motion to revive its judgment if it done within the ten year period. If that motion is made in a timely manner, the circuit court is obligated to issue the order to show cause to revive the judgment. This is merely a ministerial duty of the circuit court. It does not affect the timeliness of the revival, and does not require judgment upon the court itself.

The plain language of Rule 74.09 requires that a party seeking a revival of their judgment, for example in a Lee’s Summit auto accident case, only needs to file a motion to revive the judgment and has to do nothing more within ten years of the judgment date itself. Abbott v. Abbott, Missouri Court of Appeals Western District case number 76525, 2013; reveals that arguments to the contrary have already been rejected by the courts in Wright Industries, Inc. v. New England Propellers Service, Inc., 881 SW 2d 243 (Mo. App. WD 1994). The court in Young Electric Sign Co. v. Duchell Furniture of Arizona, Inc., 9 SW 3d 685, 687 (Mo. App. 1999) reached a similar conclusion. There is no due diligence requirement upon the party making a motion to revive its judgment if it done within the ten year period. If that motion is made in a timely manner, the circuit court is obligated to issue the order to show cause to revive the judgment. This is merely a ministerial duty of the circuit court. It does not affect the timeliness of the revival, and does not require judgment upon the court itself.

SHOULD MY DEFECTIVE DANGEROUS PRODUCT CASE REQUEST PUNITIVE DAMAGES TO PUNISH THE MANUFACTURER?

SHOULD MY DEFECTIVE DANGEROUS PRODUCT CASE REQUEST PUNITIVE DAMAGES TO PUNISH THE MANUFACTURER? The test for a punitive damages claim in an injury accident is as follows:

The test for a punitive damages claim in an injury accident is as follows: Defendants often argue that the conduct must be outrageous and include an evil motive. This is indeed the standard discussed in cases such as

Defendants often argue that the conduct must be outrageous and include an evil motive. This is indeed the standard discussed in cases such as

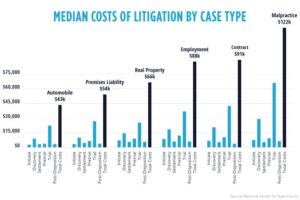

EXPLAINED: LITIGATION COSTS IN ACCIDENT INJURY CASES

EXPLAINED: LITIGATION COSTS IN ACCIDENT INJURY CASES

How to Overcome Uncertain Treating Physician Testimony in Prosthetic Amputation Lawsuits

How to Overcome Uncertain Treating Physician Testimony in Prosthetic Amputation Lawsuits With physicians, this is the “reasonable medical certainty” standard. For example, in Missouri, the Supreme Court ordered in cases like

With physicians, this is the “reasonable medical certainty” standard. For example, in Missouri, the Supreme Court ordered in cases like  A second problem is the uncertainty of future medical treatment or repercussions. Doctors helping amputation victims cannot see the future. Future treatment or negative outcomes may be dependent upon events that do not occur. This second problem is physicians saying this may not occur unless one or two or three other events happen. Therefore, they give the opinion they cannot say to a reasonable degree of certainty because they do not know the certainty of these future events. This challenge can also be overcome.

A second problem is the uncertainty of future medical treatment or repercussions. Doctors helping amputation victims cannot see the future. Future treatment or negative outcomes may be dependent upon events that do not occur. This second problem is physicians saying this may not occur unless one or two or three other events happen. Therefore, they give the opinion they cannot say to a reasonable degree of certainty because they do not know the certainty of these future events. This challenge can also be overcome. The Missouri Supreme Court in the case of

The Missouri Supreme Court in the case of  Author:

Author:

Author:

Author:

How to Unlock & Find Hidden Electronic Computer Files

How to Unlock & Find Hidden Electronic Computer Files When one presses delete on a computer, there is a data entry on the disk’s directory. This directory indicates each file as either “used” or “not used.” This status change tells the computer either it has permission to write over the data or it does not have permission to write over the data.

When one presses delete on a computer, there is a data entry on the disk’s directory. This directory indicates each file as either “used” or “not used.” This status change tells the computer either it has permission to write over the data or it does not have permission to write over the data. Multiple E-Mail Copies

Multiple E-Mail Copies

Defendants will offer to print out on physical paper the electronic files. First, this eliminates Metadata and prevents you from discovering useful information contained within it. It also hides their methods of obtaining the data, meaning more may be found that is not revealed in the physical printout.

Defendants will offer to print out on physical paper the electronic files. First, this eliminates Metadata and prevents you from discovering useful information contained within it. It also hides their methods of obtaining the data, meaning more may be found that is not revealed in the physical printout. Drug error defendants may offer to convert electronically stored information to .tif files or .pdf files. This is because .tif imaging and Adobe .pdf files do not contain the Metadata stored within them. ‘

Drug error defendants may offer to convert electronically stored information to .tif files or .pdf files. This is because .tif imaging and Adobe .pdf files do not contain the Metadata stored within them. ‘

Sometimes you do not have to directly pay the lawyer at all. Certain types of cases (like vexatious refusal to pay by insurance) carry with them awards of attorney fees. This means at the end of the case, if you win, the other side pays for your attorney’s fees.

Sometimes you do not have to directly pay the lawyer at all. Certain types of cases (like vexatious refusal to pay by insurance) carry with them awards of attorney fees. This means at the end of the case, if you win, the other side pays for your attorney’s fees. Like stairs, contingency fee amounts typically go up in steps.

Like stairs, contingency fee amounts typically go up in steps.

FIVE REASONS WHY INSURANCE COMPANIES DO NOT FAIRLY PAY ACCIDENT CLAIMS

FIVE REASONS WHY INSURANCE COMPANIES DO NOT FAIRLY PAY ACCIDENT CLAIMS